Home Page

WHAT IS A 1031 EXCHANGE?

When selling a business or investment property, and a gain would be realized, Internal Revenue Code Section 1031 provides for an exception, allowing for tax on the gain to be postponed if the proceeds are invested, in a "like-kind" property exchange. Gain deferred in this like-kind exchange under IRC Section 1031 would be tax-deferred, but not tax-free.

1031 Exchange Definition

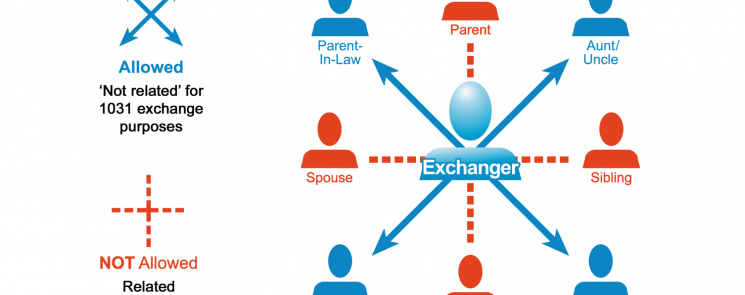

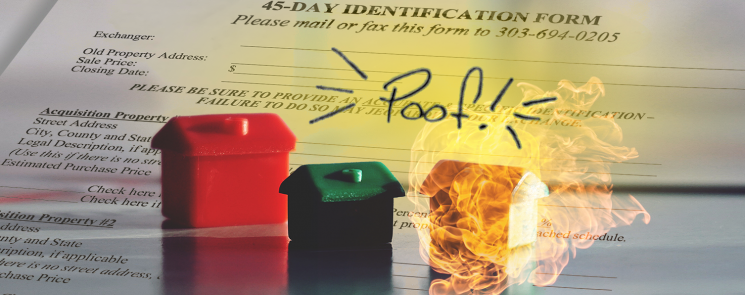

You might be wondering, how does a 1031 exchange work? There are certian rules to consider. A properly structured 1031 exchange allows an investor to sell a property, to reinvest the proceeds in a new property and to defer all capital gain taxes. IRC Section 1031 (a)(1) states:

"No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment, if such property is exchanged solely for property of like-kind which is to be held either for productive use in a trade or business or for investment."

To understand the protection a 1031 exchange offers, consider the following example for investors:

- An investor has a $200,000 capital gain and incurs a tax liability of approximately $70,000 in combined taxes (depreciation recapture, federal and state capital gain taxes) when the property is sold. Only $130,000 remains to reinvest in another real estate property.

- If we assume a 25% down payment and a 75% loan-to-value ratio, the seller would only be able to purchase a property worth $520,000.

- If the same investor chose to do a 1031 exchange, however, the entire $200,000 of equity would be able to reinvested in the purchase of $800,000 in real estate, with the same down payment and loan-to-value ratios as above.

Do you see the power of the 1031 exchange? What makes us 1031 Exchange Experts? Years of experience, and walking client after client through the process. Feel free to contact our office today for professional assistance with your 1031 exchange.