You are here

1031 News › Related Party Rules for 1031 Exchanges › Related Party Rules for 1031 ExchangesRelated Party Rules for 1031 Exchanges

Error message

Deprecated function: The each() function is deprecated. This message will be suppressed on further calls in _taxonomy_menu_trails_menu_breadcrumb_alter() (line 436 of /home/expert1031/public_html/sites/all/modules/taxonomy_menu_trails/taxonomy_menu_trails.inc).

Good properties come on the market but don't last long — sometimes only hours or minutes, and oftentimes there are multiple offers competing against you. As a result, a common question we get right now is, "can I buy a property that is owned by a relative?" Section 1031 law does not allow you to sell property to, or buy property from, a relative if your motive is "tax avoidance." But what does that mean?

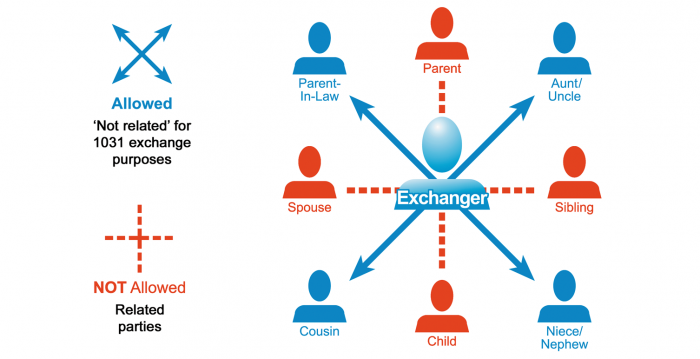

First, let's define terms: what is a related party — who is legally "related" to you for 1031 exchange purposes? The code defines a "related party" as your spouse, or someone who is closely related to you by blood: your parents, grandparents, kids and grandkids. It also includes your brothers and sisters. Those who are NOT related to you, for 1031 exchange purposes, are nieces, nephews, aunts and uncles, to name a few. Corporations, partnerships and LLCs (limited liability corporations) are also "related to you" if the entity is owned primarily by a related person or persons. "Primarily" in this case typically means that more than 50% of the entity is owned by a related person(s).

For example, if you are selling a rental property to an LLC that is owned by your father, that would violate the related party rules. But if your father only owns 33% of the LLC, and two of his buddies (who are not related to you) own the other 67%, the LLC is not considered a related party and your sale and exchange are okay.

A common question we get from married women at this point when discussing the rules is, "since my father's name is different from my married name, how would the IRS know we're related?" The answer is that they probably won't — but one of the questions on Form 8824 (the IRS form you'll use to report your exchange) asks if your exchange is with a related party. If you answer "no," and the IRS finds out that in fact you sold the property to your dad, you're in major trouble. So don't play games.

The transaction with the related party can not be for tax avoidance purposes. Here's where things really start getting murky. What is tax avoidance? No one knows since the IRS hasn't given any examples. What we DO know is that they've refused to rule on such simple common questions as, "will buying my parent's house violate the related party rules if their gain is all tax-free because it's the sale of their primary residence?" Or, "my son's a builder — can I buy one of his spec houses to use as a rental if I buy it for the same price he has it listed for sale to the public and he pays tax on the gain?" It's troubling that the IRS won't rule on questions like these. They seem so logical to you and I, but the rule of thumb they've adopted is simply, if a property is sold at a gain, and at the end of the transaction the gain is deferred by Section 1031, and the cash and the property remain within the family unit, the transaction will violate the tax avoidance intent of the law.

An easy way to avoid this problem is to have the related party also do a 1031 exchange. For example, if you sell a rental and buy an office building from your father, the transaction will violate Section 1031 unless your father also does a 1031 exchange on his sale. Assuming he does an exchange, your gain will be deferred, your dad's property will remain within the family, but since the cash doesn't (because your dad did an exchange), the transaction will not violate the related party rules. Be careful however: if you do an exchange in this situation based on the expectation that your dad is also doing an exchange, and his purchase falls through, your exchange is retroactively toast and your gain is taxable.

And that brings us to the last requirement of a related party exchange: the related party property has to remain within the family for two years following the exchange — otherwise the original exchange is retroactively taxable. In the above example, you would want to make sure you held your dad's office building for two full years after your exchange.

Remember: don't play games with related party rules. The IRS will come after you hard if they find you've hidden the relationship of the party you bought your property from.

Add new comment