You are here

1031 News › 1031 Identification Issues in a Hot Real Estate Market › 1031 Identification Issues in a Hot Real Estate Market1031 Identification Issues in a Hot Real Estate Market

Error message

Deprecated function: The each() function is deprecated. This message will be suppressed on further calls in _taxonomy_menu_trails_menu_breadcrumb_alter() (line 436 of /home/expert1031/public_html/sites/all/modules/taxonomy_menu_trails/taxonomy_menu_trails.inc).

Section 1031 is an IRS code that allows you to defer real estate capital gains taxes (in some cases, a lot of capital gains taxes). The rules aren't impossible to follow, but they aren't easy, either.

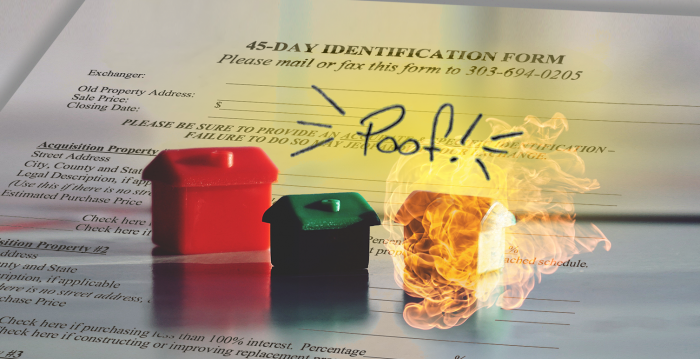

One of the rules that causes a lot of angst, especially in a fast-moving real estate market like we have now, is the requirement that you have forty-five days to make a list of replacement properties you might want to buy. Anything you purchase to complete your exchange must be on that property identification list. You create your identification list on a form provided by your Qualified Intermediary (the 1031 specialist the law requires to guide you through the process).

The identification period is forty-five calendar days and begins on the date your sale closes. That includes weekends and holidays, which means if your forty-fifth day falls on Sunday or the Fourth of July, your identification must be received by your Intermediary by midnight of that day, even if it's a weekend holiday. Email is currently the most popular method for transmitting your form to your Intermediary.

The rules allow you to identify up to three properties without a maximum price limitation. If you identify more than three properties, the IRS rules narrow and become tougher; if you identify four or more properties, the sum of the purchase price of all of the properties on your list combined cannot exceed twice the sales price of your old property. For example, if you sell your old property for $100,000 and list four potential replacement properties, the combined purchase price of all four properties can't exceed $200,000. Had you only listed three properties, the combined purchase price of all three can be $200 million or more, because there's no limit to the value of replacement properties if your list only has three replacement properties or less.

The three-or-fewer properties on your list are properties you're willing to buy. You're not required to buy all of them, but to complete your exchange, you are required to buy at least one of them. You can change the list as much as you want until midnight of the forty-fifth day. At that point, the gate slams shut and the properties on your list are cast in concrete.

What if a property you want is no longer available? This is a real possibility in a fast-moving market like we have now. The answer depends on where you are in the forty-five-day period. If you still have days left, you can remove any unavailable properties and replace them with available ones. For example, if it's day thirty of your forty-five-day period, and one of your three listed properties just sold, you can remove that address from your list and replace it with a new available property. However, if you're beyond the forty-fifth day, your list cannot be changed. That means you only have two properties left (assuming you started with three to begin with). Remember: the forty-five days are cast in concrete.

So how do you deal with this in such a fast-moving market? My advice to our clients is to start as soon as you list your property for sale. As soon as the listing process is complete, you should start looking for possible replacement properties in your price range and in your target neighborhoods. Figure out where you want to buy and what your options are within that area. Then keep an eye on that area to get a sense of their true market prices and how long things stay on the market there before they sell. Then, as soon as your old property goes under contract, you will want to get serious about making an offer.

Zero-in on your choice replacement properties and get them under contract. Set the closing date for three weeks after the contracted closing date of your old property. Why three weeks? Because three weeks is halfway through the forty-five-day identification period. If you can close your purchase during those forty-five days, you won't have to worry about making a list at all (because purchasing the new property clearly "identifies it" as your replacement property). Three weeks gives you some flexibility if the closing of the sale of your old property gets delayed, and also gives you time to find another property if something causes the closing of your first choice to fall through.

Although the rules can be restrictive, they're workable if you have a good plan in place. Having a good plan is very critical in this fast-moving market we are experiencing right now.

Add new comment