You are here

1031 News › 1031 News

1031 News

Submitted by The Experts Team on Wed, 04/01/2020 - 11:05 • Updated on Fri, 04/10/2020 - 14:33

Working Through the Crisis

We must face a harsh fact: it’s a scary time.

We’ve recently fielded lots of calls with concerns about the economic situation caused by this worldwide pandemic. We hear them, and we feel them.

Fear is normal in times like these, and to be realistic, the unexpected is still ahead. That can be paralyzing. But we should take heart: EVERY challenge America has ever faced was unexpected, unwritten, and unique to world history. And we have overcome.

The IRS has granted special relief for taxpayers whose exchange was impacted by Hurricane Ian. If you are doing a 1031 exchange anywhere in the State of Florida on property that you sold, bought or are buying, or you live in the State of Florida, the IRS has automatically extended your 1031 deadlines. After the closing of the sale of your old property, IRS law requires that within 45 days you give the agent handling your exchange a list of properties you might buy to complete your exchange, and then requires that you complete the purchase of at least one of those properties within 180 days. The Disaster Relief extends these deadlines.

Section 1031 is an IRS code section that lets you defer tax (in some cases a lot of tax), but of course they don't make the deferral easy. But it's not impossible either.

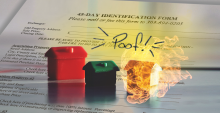

One of the rules that can cause a lot of angst, especially in a fast-moving real estate market like the one we have now, is the requirement that you identify a list of new properties you might want to buy within 45 calendar days of the closing of your Old Property. Whatever you buy to complete your exchange must be on this list. The identification is made on a form provided to you by your QI, your Qualified Intermediary (the 1031 specialist the law requires you to use to guide you through this process).

In a real estate market moving as fast as it is right now, "flipping" property seems to be the favorite pastime. Flipping is when you buy a property with the intent of turning around and selling it soon after the purchase. But can you do a 1031 exchange and defer the gain in a flip situation?

To qualify for a 1031 exchange, which rolls the gain from the sale of the Old Property to the New, both properties have to be held as an investment or used in a trade or business. Held for investment means you intend to hold the property for future appreciation over time. Used in a trade or business means the property produces income, like rental property. Since you don't rent the property in a flip, it isn't income-producing. So the question is, can a fix-and-flip be 'held-for-investment?'

Good properties come on the market but don't last long — sometimes only hours or minutes, and oftentimes there are multiple offers competing against you. As a result, a common question we get right now is, "can I buy a property that is owned by a relative?" Section 1031 law does not allow you to sell property to, or buy property from, a relative if your motive is "tax avoidance." But what does that mean?

Section 1031 is an IRS code that allows you to defer real estate capital gains taxes (in some cases, a lot of capital gains taxes). The rules aren't impossible to follow, but they aren't easy, either.

One of the rules that causes a lot of angst, especially in a fast-moving real estate market like we have now, is the requirement that you have forty-five days to make a list of replacement properties you might want to buy. Anything you purchase to complete your exchange must be on that property identification list. You create your identification list on a form provided by your Qualified Intermediary (the 1031 specialist the law requires to guide you through the process).

The Internal Revenue Service recently announced that Texas taxpayers—including 1031 exchangers—can have up to June 15, 2021 to file returns, identify replacement property, purchase replacement property, or make other payments due to the chaos caused by February’s winter storms.

For affected Texans, FEMA has issued a disaster declaration for the entire state. Other tax-related accommodations can be made for taxpayers in other states impacted by these winter storms. A list of eligible localities can be found at irs.gov on their disaster relief page.

Finally, the dust appears to have settled, the drama has ended, and the Biden regime has begun. So where are we now, and what do I think the 1031 Exchange industry can expect in the foreseeable future?

I've been writing a prediction article every year or so since about 1998—especially when we've had a Presidential regime change. I've struggled with writing this article more than any other because, frankly, I don't have a clear vision of what's going to happen next. So I'm going to start with big, broad categories, then break them down into smaller details. In the end, I'll try to tie them all together into a prediction of where the 1031 industry is going.

Partnerships holding real estate investments face major challenges when some partners want to do a 1031 exchange while others want to cash out at the sale. But there are a number of options that can allow all the partners to get what they want. Timing and planning are required to meet both the IRS partnership and 1031 exchange rules. Here are just a few of those strategies:

1. The Drop and Swap Method. Real estate investment partnerships can be distributed to the partners as a separate “tenancy in common interest,” and the partnership entity is dissolved. Property is then held for at least a year prior to the sale and each tenant in common owner can either cash out or participate in individual 1031 exchanges. There are stringent IRS tenant in common ownership requirements that must be met per Revenue Proc 2002-22, including annual management agreements.

Due to economic factors or life changes, investors who have held vacation rental property for many years can face significant tax liabilities when they sell it. Federal long term capital gain tax rates can be anywhere from 15 to 20%. The unearned income tax rate is 3.8%, and a depreciation recapture at 25% could be incurred. Additionally, state tax rates will also apply. Adding it all up, a potential tax liability upwards of around 39% can come as a rude surprise for most investors.

So what other options do investors have to limit or defer their tax liability? One option is to convert the use of the property into your primary residence. Another is to do a 1031 Exchange.

Pages

It Doesn’t End at 15%

The role of debt in a 1031 exchange

THE FUTURE of The 1031 Exchange Industry