You are here

This Weeks TEE-Shot › This Weeks TEE-Shot

This Weeks TEE-Shot

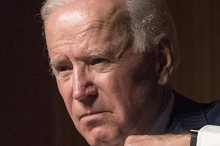

The Tax Plan proposed by Democratic Presidential Candidate Joe Biden eliminates 1031 Exchanges for investors with an annual net income of $400,000 or more. If one assumes that the $400,000 cap includes gain from the sale of real estate, most investment property sales would not qualify for 1031 exchange tax treatment.

Along with the proposed increase of the personal income tax rate, as well as the long-term capital gain tax rate, selling an investment property would become a highly taxable situation. The long-term effect on the real estate investment market could be extremely negative.

In light of this proposed tax plan, is it time to get your real estate holdings in order? Contact the 1031 Exchange Experts for questions, or to discuss 1031 exchange strategies, at 303-694-0204 or info@expert1031.com.

A qualified exchange consultant is ready to assist.

We occasionally get a client who, for one reason or another, is unable to complete their exchange, usually because they cannot find suitable replacement property. If they don’t identify ANY replacement property, their exchange ends at midnight on the 45th day. We return their funds to them the next day and they pay tax on the sale. If they DO identify replacement property by the 45th day, their exchange continues until either: A) they purchase their new property, or B) their replacement period expires on the 180th day. If they don’t purchase, their exchange funds are then returned on the 181st day. Again, their sale is taxable because they did not complete the exchange.

It Doesn’t End at 15%

The role of debt in a 1031 exchange

THE FUTURE of The 1031 Exchange Industry