You are here

This Weeks TEE-Shot › TEE-Shot: Exchanger Beware: Biden’s Tax Plan Implodes 1031 Exchanges › TEE-Shot: Exchanger Beware: Biden’s Tax Plan Implodes 1031 ExchangesTEE-Shot: Exchanger Beware: Biden’s Tax Plan Implodes 1031 Exchanges

Error message

Deprecated function: The each() function is deprecated. This message will be suppressed on further calls in _taxonomy_menu_trails_menu_breadcrumb_alter() (line 436 of /home/expert1031/public_html/sites/all/modules/taxonomy_menu_trails/taxonomy_menu_trails.inc).

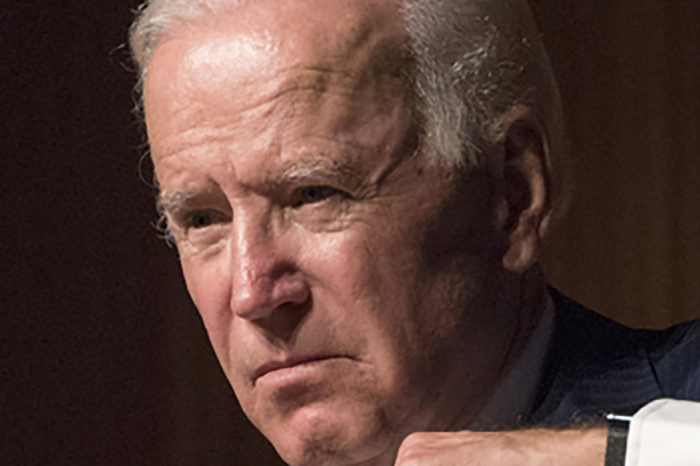

The Tax Plan proposed by Democratic Presidential Candidate Joe Biden eliminates 1031 Exchanges for investors with an annual net income of $400,000 or more. If one assumes that the $400,000 cap includes gain from the sale of real estate, most investment property sales would not qualify for 1031 exchange tax treatment.

Along with the proposed increase of the personal income tax rate, as well as the long-term capital gain tax rate, selling an investment property would become a highly taxable situation. The long-term effect on the real estate investment market could be extremely negative.

In light of this proposed tax plan, is it time to get your real estate holdings in order? Contact the 1031 Exchange Experts for questions, or to discuss 1031 exchange strategies, at 303-694-0204 or info@expert1031.com.

A qualified exchange consultant is ready to assist.

Add new comment